China’s Zero-Tariff Offer to Africa: Opportunity, Asymmetry, and the Road Ahead

The decision by China to unilaterally abolish tariffs on exports from 53 African countries represents a transformative shift in the geopolitical and geoeconomic landscape. The decision was announced during the Ministerial Meeting of Coordinators on the Implementation of the Follow-up Actions of the Forum on China-Africa Cooperation (FOCAC) held in Changsha, Hunan Province in Chana from June 10-12, 2025.It comes at a time when the continent is grappling with the looming possibility of increased tariffs on its products entering the U.S. and rising uncertainties surrounding the future of the African Growth and Opportunity Act (AGOA).This latest policy builds on an earlier move implemented on December 1, 2024, when China eliminated tariffs on imports from Least Developed Countries (LDCs), 33 of which are in Africa.

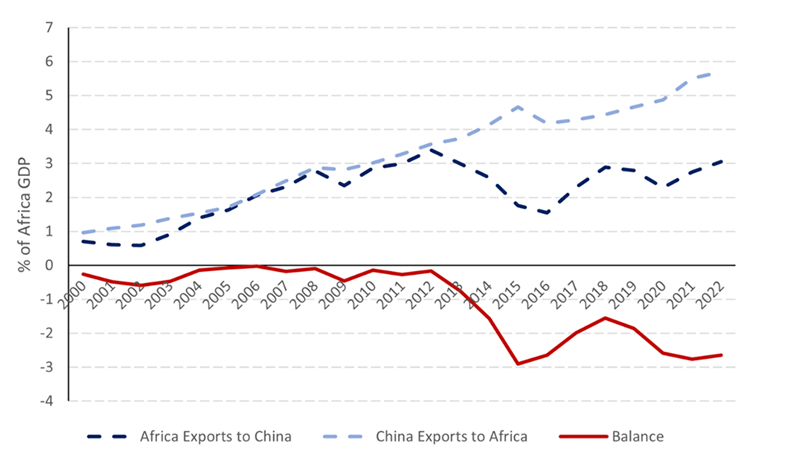

Although trade between Africa and China has expanded, many African countries continue to face growing trade deficits, as depicted in Figure 1. And while exports in both directions have increased, the gap has widened considerably since 2013, with China’s exports to Africa outpacing Africa’s exports to China. Measured as a share of Africa’s GDP, imports from China have consistently surpassed the worth of Africa’s shipments to Chinese markets. In value terms, the total volume of Africa-China trade surged from $11.67 billion in 2000 to $277.89 billion in 2022, reflecting an expansion in economic engagement (BU, Global Development Center, 2024; Global Finance, 2024).

Figure 1: Africa’s Trade Balance with China (2000–2022)

Over the same period, however, Africa’s principal trading partners have shifted from traditional Western economies like the United Kingdom, France, and the United States to China, underscoring Beijing’s growing influence in the continent’s trade landscape. In 2023, China further solidified its position as Africa’s largest bilateral trading partner, with total trade reaching a record $282.1 billion, a 1.5% increase from the previous year. However, this growth was driven largely by a 7.5% surge in Chinese exports to Africa, which rose to $173 billion. In contrast, African exports to China declined by 6.7%, falling to $109 billion, thereby widening the continent’s trade deficit with China to $64 billion, up from $46.9 billion in 2022 (Global Finance, 2024).

While the zero-tariff gesture appears generous to bridge the trade deficit gap, it is more likely an assertive recalibration by China aimed at achieving three intertwined and strategic objectives:

- insulating Chinese supply chains from Western volatility,

- securing preferential access to Africa’s resource base, and

- expanding China’s soft power influence through trade, not just infrastructure diplomacy.

The decision to include middle-income economies like Egypt, South Africa, Kenya, and Nigeria in this duty-free policy demonstrates China’s intent to reshape the framework of South-South cooperation, beyond immediate economic gains. For African economies, this development offers unprecedented market access, but access alone does not translate to advantage. Without immediate and strategic interventions to scale industrial capacity, address standards compliance, and enhance logistics infrastructure, the benefits of this policy will remain asymmetrical.

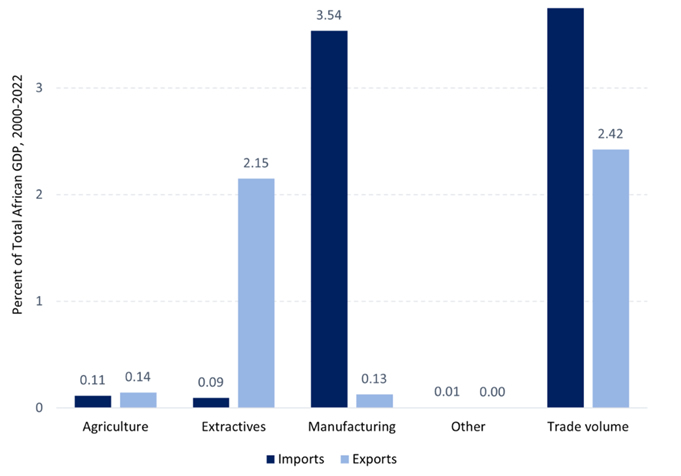

This asymmetry is further heightened by the sectoral composition of Africa’s trade with China. As Figure 2 shows, from 2000 to 2022, Africa’s exports to China were overwhelmingly concentrated in extractives, which accounted for 2.15% of total African GDP, while exports of manufactured goods remained marginal at just 0.13%. In contrast, China’s exports to Africa were dominated by manufactured products, representing a substantial 3.54% of African GDP. This reflects a structural trade pattern in which Africa continues to supply raw materials and import high-value manufactured goods. While agriculture plays a relatively small role, both in exports and imports, the stark disparity in manufacturing points to missed opportunities for industrial upgrading.

Figure 2: Sectoral Composition of Africa – China Trade (2000–2022)

Thus, this move by China should be viewed as a strategic nudge not a lifeline. China’s pivot is also a response to Western efforts at nearshoring and friendshoring in response to rising global trade uncertainty. In this context, what we are witnessing is not charity, but could possibly be Afroshoring (relocation or expansion of supply chains, production, or trade partnerships into African countries): a long-standing effort to lock in African supply as the world decouples.

We at the International Perspective for Policy & Governance (IPPG)caution against romanticizing this development without deeper scrutiny. African governments must approach this new window with clarity: What is our trade vision with China? What safeguards are in place to prevent resource drain? What investments are being made in trade-ready, value-added sectors?

If strategically aligned with the African Continental Free Trade Area (AfCFTA), the zero-tariff access to China could catalyze Africa’s industrialization, stimulate rural economies, and unlock new partnerships in climate-smart agriculture, green minerals, renewable energy, and tech-enabled services. But without deliberate policy alignment and implementation, it may simply entrench “extractivism” under a new guise. The question is not whether this is a win, the real question remains: win for whom, and for how long?Africa must define the terms of its trade future with ambition, caution, and resolve!

For media and policy enquiries, please contact:

Roselyn BuerkiPlahar

r.buerkiplahar@ippgafrica.org

Disclaimer:

This strategic statement reflects the independent analysis and policy perspectives of the International Perspective for Policy & Governance (IPPG). It is intended to inform constructive dialogue on Africa’s trade strategy in a rapidly evolving global context. The views expressed do not represent any specific donor, government, or external partner, and are guided solely by IPPG’s commitment to evidence-based research and African development priorities.

Previous Post

Previous Post Next Post

Next Post